[ad_1]

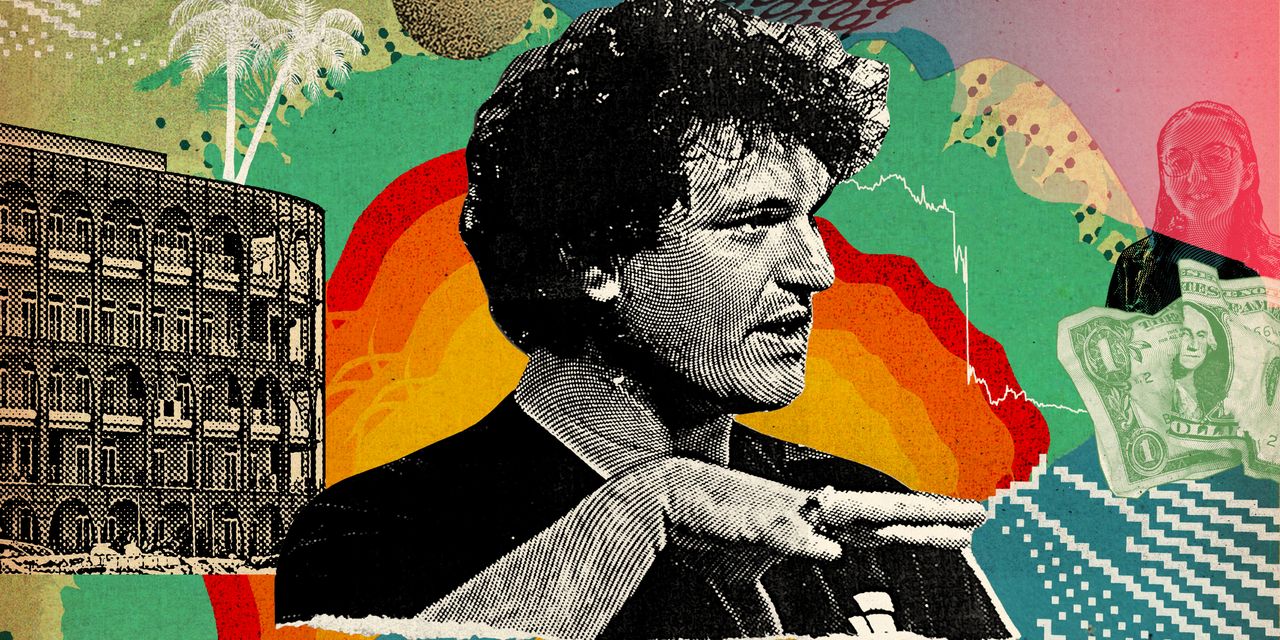

NASSAU, Bahamas—Sam Bankman-Fried’s $32 billion crypto-trading empire collapsed in an incandescent bankruptcy last week, prompting irate customers, crypto acolytes and Silicon Valley bigwigs to ask how something that seemed so promising could have imploded so fast.

The emerging picture suggests FTX wasn’t simply felled by a rival, or undone by a bad trade or the relentless fall this year in the value of cryptocurrencies. Instead, it had long been a chaotic mess. From its earliest days, the firm was an unruly agglomeration of corporate entities, customer assets and Mr. Bankman-Fried himself, according to court papers, company balance sheets shown to bankers and interviews with employees and investors. No one could say exactly what belonged to whom. Prosecutors are now investigating its collapse.

[ad_2]

Source link

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Zosia VanMeter becomes Director of Inspection

Saugus playground gets revamped – Itemlive

Fatal Mattituck fire raises questions about rental safety

Photos: CAST’s 5th Annual Festival of Trees lights up Treiber Farms in Peconic

Daily Update: Fatal Mattituck fire raises questions about rental safety

Lynn football luncheon scores big

Police Logs 11/27/24 – Itemlive

Marblehead strike settled – Itemlive

Four Classical greats honored in City Hall

Swampscott hosts Thanksgiving Hero Meals

Controversial project redesign OK’d in Peabody

LYSOA celebrates its relaunch with a new logo and expanded program